Business

Tullow Oil Shares Surge 23.1%: Market Analysts Weigh In

Tullow Oil plc (LON: TLW) experienced a significant surge in its stock price, rising by 23.1% during trading on Wednesday. The stock reached a peak of GBX 4.90 before closing at GBX 4.80, up from the previous close of GBX 3.90. This spike in price was accompanied by a notable increase in trading volume, with approximately 38,513,406 shares exchanged—an impressive 266% rise compared to the average daily volume of 10,528,255 shares.

Investors are keenly observing Tullow Oil’s stock performance, especially in light of recent analyst reports. Various research firms have issued updates regarding the company’s market position. For instance, on October 20, 2023, Jefferies Financial Group reduced its target price for Tullow Oil from GBX 12 to GBX 6, assigning an “underperform” rating. In contrast, Shore Capital reaffirmed a “buy” rating in a report from September 5, 2023.

Panmure Gordon also adjusted its outlook, lowering its target price from GBX 7.80 to GBX 5.40 and recommending a “sell” rating on the stock. Meanwhile, Canaccord Genuity Group decreased its target price from GBX 16 to GBX 10 while maintaining a “hold” rating. Currently, Tullow Oil holds an average rating of “Reduce” from analysts, with a consensus target price of GBX 12.85.

Company Overview and Future Commitment

Tullow Oil is an independent energy company focused on responsible oil and gas development, primarily in Africa. Its operations are concentrated on producing assets in Ghana, Gabon, and Côte d’Ivoire, along with significant resources discovered in Kenya. The company has set ambitious goals, committing to achieve Net Zero emissions on its Scope 1 and 2 emissions by 2030.

Tullow’s “Shared Prosperity” strategy aims to deliver lasting socio-economic benefits to the nations in which it operates. This commitment highlights the company’s focus on sustainable development alongside its business goals.

As Tullow Oil continues to navigate market dynamics, investors and analysts remain vigilant about its stock performance and strategic initiatives. With a mixed bag of analyst ratings and a significant increase in trading volume, the company is poised for continued attention in the energy sector.

-

Science2 months ago

Science2 months agoUniversity of Hawaiʻi Joins $25.6M AI Initiative to Monitor Disasters

-

Science3 months ago

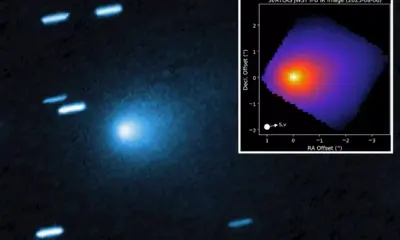

Science3 months agoInterstellar Object 3I/ATLAS Emits Unprecedented Metal Alloy

-

Lifestyle3 months ago

Lifestyle3 months agoToledo City League Announces Hall of Fame Inductees for 2024

-

Business3 months ago

Business3 months agoDOJ Seizes $15 Billion in Bitcoin from Major Crypto Fraud Network

-

Science3 months ago

Science3 months agoWestern Executives Confront Harsh Realities of China’s Manufacturing Edge

-

Top Stories3 months ago

Top Stories3 months agoSharp Launches Five New Aquos QLED 4K Ultra HD Smart TVs

-

Politics3 months ago

Politics3 months agoMutual Advisors LLC Increases Stake in SPDR Portfolio ETF

-

Health3 months ago

Health3 months agoCommunity Unites for 7th Annual Walk to Raise Mental Health Awareness

-

Sports3 months ago

Sports3 months agoCeltics Coach Joe Mazzulla Dominates Local Media in Scrimmage

-

Politics3 months ago

Politics3 months agoMajor Networks Reject Pentagon’s New Reporting Guidelines

-

World3 months ago

World3 months agoINK Entertainment Launches Exclusive Sofia Pop-Up at Virgin Hotels

-

Top Stories3 months ago

Top Stories3 months agoMicrosoft Releases Urgent Windows 11 25H2 Update for All Users