Business

Cut the Financial Cord: Parents Reassess Support for Adult Kids

The financial dynamics between parents and their adult children are changing as many retirees reassess their support for grown offspring. Recent studies indicate that parents often jeopardize their own retirement security by continuing to provide substantial financial assistance to their children. Experts emphasize the need for parents to establish boundaries to ensure their long-term financial health.

A report by the AARP reveals that nearly 70% of parents aged 50 and older provide financial support to their adult children. This assistance often includes contributions towards housing, education, and even daily expenses. While the intention is to help, this practice can significantly deplete retirement savings and lead to financial strain for parents.

Understanding the Financial Impact

A survey conducted by the National Endowment for Financial Education found that parents who support their adult children financially may be putting their own future at risk. Over 60% of those surveyed reported that their retirement savings were negatively affected by these ongoing financial commitments. Parents frequently underestimate the long-term implications of their financial support, leading to challenges in maintaining their desired retirement lifestyle.

Financial planning experts recommend that parents evaluate their financial situation critically before offering assistance. It is essential to consider factors such as current savings, expected retirement expenses, and any existing debts. Establishing a detailed budget can help parents identify how much support, if any, they can afford to provide without compromising their retirement goals.

Setting Boundaries and Communicating Effectively

One effective strategy for parents is to set clear boundaries regarding financial support. This involves openly discussing their financial limitations with their adult children. Experts advise using compassionate communication to explain the importance of prioritizing retirement savings over ongoing financial assistance.

Additionally, parents can encourage their children to seek financial independence. This might involve helping them develop budgeting skills, find job opportunities, or explore other resources. By fostering self-sufficiency, parents can gradually reduce their financial support while still providing emotional backing.

Parents should also consider the timing of their financial support. Rather than providing ongoing assistance, they may opt for one-time contributions for significant expenses, such as a down payment on a home. This approach can help preserve their retirement funds while still offering valuable help.

As financial pressures continue to mount, parents must take proactive steps to protect their retirement savings. By reevaluating their financial support to adult children, they can ensure a more secure future for themselves. Balancing compassion with financial responsibility is crucial for maintaining both personal and familial stability.

-

Science2 months ago

Science2 months agoUniversity of Hawaiʻi Joins $25.6M AI Initiative to Monitor Disasters

-

Science3 months ago

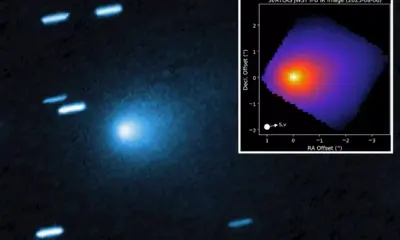

Science3 months agoInterstellar Object 3I/ATLAS Emits Unprecedented Metal Alloy

-

Lifestyle3 months ago

Lifestyle3 months agoToledo City League Announces Hall of Fame Inductees for 2024

-

Business3 months ago

Business3 months agoDOJ Seizes $15 Billion in Bitcoin from Major Crypto Fraud Network

-

Science3 months ago

Science3 months agoWestern Executives Confront Harsh Realities of China’s Manufacturing Edge

-

Top Stories3 months ago

Top Stories3 months agoSharp Launches Five New Aquos QLED 4K Ultra HD Smart TVs

-

Politics3 months ago

Politics3 months agoMutual Advisors LLC Increases Stake in SPDR Portfolio ETF

-

Sports3 months ago

Sports3 months agoCeltics Coach Joe Mazzulla Dominates Local Media in Scrimmage

-

Health3 months ago

Health3 months agoCommunity Unites for 7th Annual Walk to Raise Mental Health Awareness

-

Politics3 months ago

Politics3 months agoMajor Networks Reject Pentagon’s New Reporting Guidelines

-

World3 months ago

World3 months agoINK Entertainment Launches Exclusive Sofia Pop-Up at Virgin Hotels

-

Top Stories3 months ago

Top Stories3 months agoMicrosoft Releases Urgent Windows 11 25H2 Update for All Users