Business

Seascape Capital Invests $4.33 Million in Monster Beverage Corporation

Seascape Capital Management has made a significant move by investing approximately $4.33 million in Monster Beverage Corporation (NASDAQ: MNST) during the third quarter of 2023. This investment involved the purchase of 64,258 shares of Monster’s stock, marking the company as the 29th largest holding in Seascape’s investment portfolio, which now allocates about 1.2% of its resources to Monster.

This strategic acquisition is part of a broader trend among institutional investors and hedge funds, which have recently adjusted their positions in Monster Beverage. For instance, Access Investment Management LLC acquired an initial stake valued at $25,000 during the second quarter, while Salomon & Ludwin LLC purchased shares worth around $28,000. Armstrong Advisory Group Inc. increased its holdings by 49%, bringing its total to 444 shares valued at $30,000 after adding 146 shares in the third quarter.

Newbridge Financial Services Group Inc. experienced a remarkable lift in its holdings, rising by 1,338.7% during the second quarter, now owning 446 shares valued at $28,000. Similarly, Golden State Wealth Management LLC expanded its stake by 647.3% in the same period, owning 553 shares worth $35,000. Notably, institutional investors and hedge funds collectively own 72.36% of Monster’s stock.

Recent Insider Transactions and Stock Performance

In addition to institutional shifts, significant insider transactions have taken place. On December 12, 2023, Director Rodney C. Sacks sold 206,543 shares at an average price of $73.58, totaling approximately $15.20 million. Another insider, Emelie Tirre, sold 30,000 shares on the same day for around $2.20 million, resulting in a 31.94% reduction in her ownership stake. Over the past 90 days, insiders have sold 274,981 shares valued at $20.14 million, with insiders currently holding 8.30% of the company’s shares.

Monster Beverage’s stock opened at $76.67 on November 6, 2023, following a positive earnings report. The company reported earnings per share (EPS) of $0.56, surpassing analysts’ expectations of $0.48. The revenue for the quarter reached $2.20 billion, exceeding the consensus estimate of $2.11 billion. This represents a year-over-year revenue growth of 16.8%, contributing to a return on equity of 27.76% and a net margin of 21.65%.

Overview of Monster Beverage Corporation

Monster Beverage Corporation, headquartered in the United States, primarily focuses on the production of energy drinks, notably the Monster Energy brand. The company has diversified its product offerings to include carbonated energy drinks, ready-to-drink energy coffees, and various flavored functional beverages. Originally established around the Hansen’s Natural line of juices and sodas, Monster transitioned to the energy drink sector in the early 2010s, officially adopting its current name to reflect this strategic pivot.

As the company continues to expand its market presence, analysts project that Monster Beverage will post an EPS of 1.62 for the current fiscal year. With a market capitalization of $74.91 billion, the company maintains a price-to-earnings (P/E) ratio of 43.56 and a price-to-earnings growth (PEG) ratio of 2.32. The stock has demonstrated resilience, with a one-year low of $45.70 and a high of $78.31.

This investment by Seascape Capital Management and the overall performance of Monster Beverage demonstrate a growing confidence in the energy drink market, reflecting broader trends in consumer preferences and the potential for sustained growth in the beverage sector.

-

Science2 months ago

Science2 months agoUniversity of Hawaiʻi Joins $25.6M AI Initiative to Monitor Disasters

-

Science3 months ago

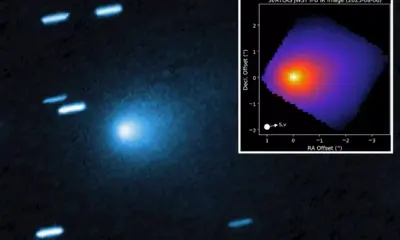

Science3 months agoInterstellar Object 3I/ATLAS Emits Unprecedented Metal Alloy

-

Lifestyle3 months ago

Lifestyle3 months agoToledo City League Announces Hall of Fame Inductees for 2024

-

Business3 months ago

Business3 months agoDOJ Seizes $15 Billion in Bitcoin from Major Crypto Fraud Network

-

Science3 months ago

Science3 months agoWestern Executives Confront Harsh Realities of China’s Manufacturing Edge

-

Politics3 months ago

Politics3 months agoMutual Advisors LLC Increases Stake in SPDR Portfolio ETF

-

Top Stories3 months ago

Top Stories3 months agoSharp Launches Five New Aquos QLED 4K Ultra HD Smart TVs

-

Health3 months ago

Health3 months agoCommunity Unites for 7th Annual Walk to Raise Mental Health Awareness

-

Sports3 months ago

Sports3 months agoCeltics Coach Joe Mazzulla Dominates Local Media in Scrimmage

-

Politics3 months ago

Politics3 months agoMajor Networks Reject Pentagon’s New Reporting Guidelines

-

World3 months ago

World3 months agoINK Entertainment Launches Exclusive Sofia Pop-Up at Virgin Hotels

-

Top Stories3 months ago

Top Stories3 months agoMicrosoft Releases Urgent Windows 11 25H2 Update for All Users