Health

Minnesota Senate Subcommittee Examines Surging Health Insurance Costs

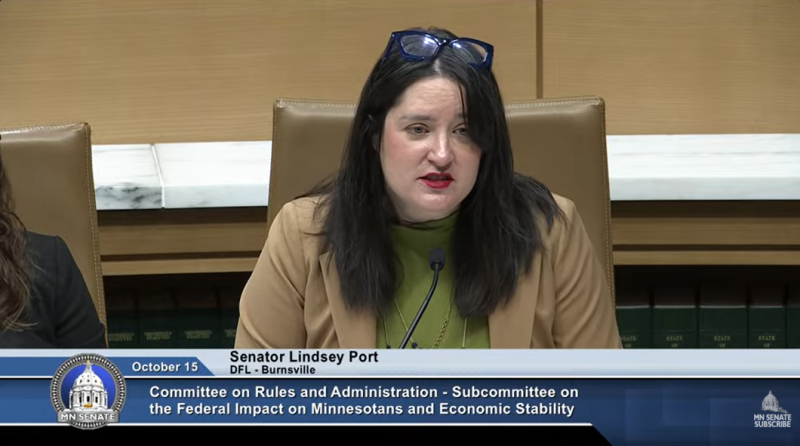

A Minnesota Senate subcommittee convened on October 15, 2023, to address the rising costs of health insurance as residents prepare to select their plans for 2026. Chaired by Sen. Lindsey Port, DFL-Burnsville, the Subcommittee on the Federal Impact on Minnesotans and Economic Stability heard from various stakeholders, including hospitals, insurance experts, and business owners. The discussions highlighted the financial challenges faced by Minnesotans purchasing insurance on the individual market.

Sen. Port noted that many individuals are experiencing “sticker shock” as they begin their insurance shopping for the upcoming year. A significant concern raised during the hearing was the impending expiration of the enhanced advance premium tax credit at the end of 2025. This tax credit benefits those earning more than 400% of the Federal Poverty Guidelines (FPG), helping reduce monthly premium costs. Current estimates indicate that approximately half of the 187,000 Minnesotans who rely on the individual market for health insurance will be directly impacted by this change.

Grace Arnold, commissioner of the Minnesota Department of Commerce, stated that “Minnesota estimates that 90,000 Minnesotans will see a cost increase averaging $2,000 a year.” This change comes alongside a projected 21.5% increase in average premiums for individual market plans in 2026. Arnold explained that as younger, healthier adults are likely to drop their insurance due to rising costs, the insurance pool will shift towards older, sicker individuals who require more healthcare services, resulting in further rate increases.

The ramifications of these changes extend beyond individual consumers. Libby Caulum, CEO of MNsure, provided a specific example involving a family of four in Freeborn County with an income of $105,000, or 325% of the FPG. In 2025, this family would pay approximately $143 per month after tax credits. However, if they maintain the same plan in 2026, their net premium is expected to rise to $490 per month due to reduced tax credits.

The hearing followed the initiation of the MNsure open enrollment period for 2026, which begins on November 1. Testimony also included discussions on the projected impacts of federal Medicaid changes introduced through the One Big Beautiful Bill Act. Lynn Blewett, a professor at the University of Minnesota’s School of Public Health, estimated that Minnesota could face a loss of up to $154 million in fiscal year 2026 as a result of these changes, with an estimated 170,000 to 180,000 individuals potentially losing coverage primarily due to new work and verification requirements.

The financial implications for hospitals were also a major focus. The Minnesota Hospital Association projected that with reduced Medicaid enrollment, the state’s hospitals could face a collective loss of $354 million in Medicaid payments annually, alongside an increase of $269 million in charity care for low-income patients. Mary Krinkie, vice president of government relations at the association, emphasized the precarious position of nonprofit hospitals in Minnesota, warning that service closures could become necessary if these financial pressures continue.

The challenges facing rural hospitals were highlighted by Zander Abbott, president and CEO of Northfield Hospital and Clinics, who noted that closures at nearby facilities would only increase demand at those remaining. “We’re not going anywhere,” Abbott affirmed. “We’re going to be around to serve the people in our communities, but this is making it harder and harder.”

In closing remarks, Sen. Carla Nelson, R-Rochester, urged the subcommittee to focus on actionable solutions to rising healthcare costs, referencing previous state budget surpluses that had not been allocated to healthcare needs. Nelson called on federal lawmakers to end the government shutdown and to renew the enhanced tax credit, emphasizing the need for local control over healthcare issues.

Following the hearing, the DFL members of the subcommittee addressed the federal government shutdown, stressing the importance of renewing the enhanced tax credit and reversing recent Medicaid cuts. The subcommittee, which is part of the state Senate’s Committee on Rules and Administration, had its first hearing on October 1, 2023, focusing on federal cuts to the Supplemental Nutrition Assistance Program (SNAP). As of October 15, no additional hearings have been scheduled.

-

Science4 weeks ago

Science4 weeks agoUniversity of Hawaiʻi Joins $25.6M AI Initiative to Monitor Disasters

-

Lifestyle2 months ago

Lifestyle2 months agoToledo City League Announces Hall of Fame Inductees for 2024

-

Business2 months ago

Business2 months agoDOJ Seizes $15 Billion in Bitcoin from Major Crypto Fraud Network

-

Top Stories2 months ago

Top Stories2 months agoSharp Launches Five New Aquos QLED 4K Ultra HD Smart TVs

-

Sports2 months ago

Sports2 months agoCeltics Coach Joe Mazzulla Dominates Local Media in Scrimmage

-

Politics2 months ago

Politics2 months agoMutual Advisors LLC Increases Stake in SPDR Portfolio ETF

-

Health2 months ago

Health2 months agoCommunity Unites for 7th Annual Walk to Raise Mental Health Awareness

-

Science2 months ago

Science2 months agoWestern Executives Confront Harsh Realities of China’s Manufacturing Edge

-

World2 months ago

World2 months agoINK Entertainment Launches Exclusive Sofia Pop-Up at Virgin Hotels

-

Politics2 months ago

Politics2 months agoMajor Networks Reject Pentagon’s New Reporting Guidelines

-

Science1 month ago

Science1 month agoAstronomers Discover Twin Cosmic Rings Dwarfing Galaxies

-

Top Stories1 month ago

Top Stories1 month agoRandi Mahomes Launches Game Day Clothing Line with Chiefs