World

Bank of England Chief Economist Urges Caution on Rate Cuts

The Chief Economist of the Bank of England (BOE), Huw Pill, has emphasized the need for a more cautious approach to future interest rate cuts, citing persistent inflationary pressures in the United Kingdom. Pill’s remarks come as the BOE considers its monetary policy strategy amid ongoing economic challenges.

In a recent statement, Pill acknowledged the complexities surrounding the current inflation rates, which have remained stubbornly high despite previous efforts to curb them. He expressed concerns that a rapid pace of interest rate reductions could undermine the progress made in stabilizing prices.

Inflation Remains a Key Concern

The latest data reveals that inflation in the UK has not decreased as anticipated. The Consumer Prices Index (CPI) shows inflation hovering around 6.7% as of August 2023, significantly above the BOE’s target of 2%. This situation has prompted calls for a more gradual approach to rate adjustments, as a hasty reduction could exacerbate inflationary trends.

Pill’s caution reflects a broader sentiment within the BOE’s Monetary Policy Committee, which has been tasked with navigating the delicate balance between supporting economic growth and maintaining price stability. In recent meetings, committee members have voiced differing opinions on the appropriate speed and extent of interest rate cuts, indicating the complexity of the current economic landscape.

Future Monetary Policy Directions

The BOE has faced mounting pressure to respond to both domestic and international economic conditions. Factors such as energy prices, supply chain disruptions, and geopolitical tensions have all contributed to the current inflationary environment. Pill highlighted the importance of a measured approach, suggesting that the BOE should avoid making abrupt policy shifts that could destabilize the economy.

As the BOE prepares for its next policy meeting, scheduled for September 21, 2023, the insights from Pill and other committee members will play a crucial role in shaping future monetary decisions. Policymakers will need to weigh the risks of high inflation against the potential benefits of stimulating economic growth through lower interest rates.

In conclusion, Huw Pill’s call for caution reflects the ongoing challenges the Bank of England faces in balancing monetary policy. With inflation remaining a significant concern, the BOE’s approach to interest rate cuts will be closely monitored by economists and market participants alike. The decisions made in the coming months will have far-reaching implications for the UK economy.

-

Science2 months ago

Science2 months agoUniversity of Hawaiʻi Joins $25.6M AI Initiative to Monitor Disasters

-

Science3 months ago

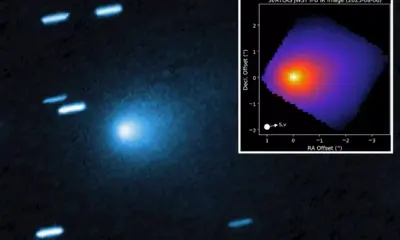

Science3 months agoInterstellar Object 3I/ATLAS Emits Unprecedented Metal Alloy

-

Lifestyle3 months ago

Lifestyle3 months agoToledo City League Announces Hall of Fame Inductees for 2024

-

Business3 months ago

Business3 months agoDOJ Seizes $15 Billion in Bitcoin from Major Crypto Fraud Network

-

Science3 months ago

Science3 months agoWestern Executives Confront Harsh Realities of China’s Manufacturing Edge

-

Politics3 months ago

Politics3 months agoMutual Advisors LLC Increases Stake in SPDR Portfolio ETF

-

Top Stories3 months ago

Top Stories3 months agoSharp Launches Five New Aquos QLED 4K Ultra HD Smart TVs

-

Health3 months ago

Health3 months agoCommunity Unites for 7th Annual Walk to Raise Mental Health Awareness

-

Sports3 months ago

Sports3 months agoCeltics Coach Joe Mazzulla Dominates Local Media in Scrimmage

-

Politics3 months ago

Politics3 months agoMajor Networks Reject Pentagon’s New Reporting Guidelines

-

World3 months ago

World3 months agoINK Entertainment Launches Exclusive Sofia Pop-Up at Virgin Hotels

-

Top Stories3 months ago

Top Stories3 months agoMicrosoft Releases Urgent Windows 11 25H2 Update for All Users