Business

Amgen Inc. Stock Analysis: P/E Ratio Signals Caution for Investors

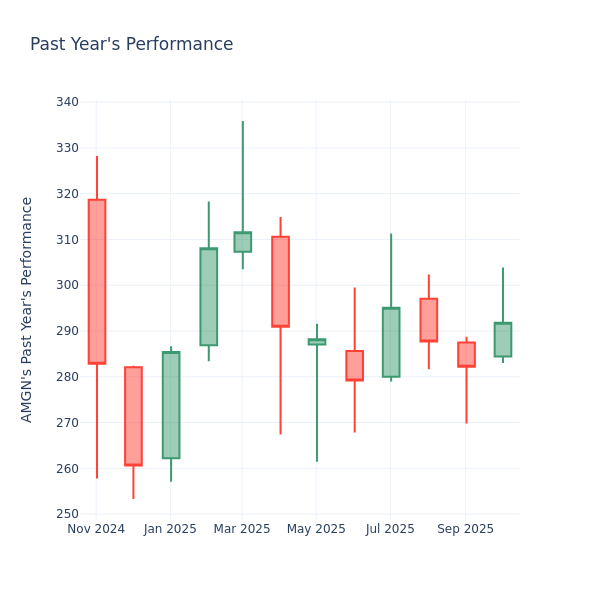

Amgen Inc. (NASDAQ:AMGN) is currently trading at $291.80, reflecting a slight decrease of 0.07% in today’s session. Over the past month, the stock has experienced a decline of 2.04%, and it has fallen by 7.92% over the past year. With this performance, long-term shareholders are increasingly scrutinizing the company’s price-to-earnings (P/E) ratio to gauge future prospects.

Understanding Amgen’s P/E Ratio Compared to Industry Standards

The P/E ratio is a critical metric for investors, allowing them to assess a company’s market performance in relation to its historical earnings and the broader industry. Currently, Amgen’s P/E ratio is notably lower than the average P/E ratio of 152.02 for the Biotechnology industry. This could suggest that investors either do not anticipate significant future growth for Amgen or that the stock may be undervalued.

A lower P/E ratio can indicate various scenarios. On one hand, it may reflect a lack of confidence in the company’s future performance. On the other hand, it could signify that the stock is undervalued, presenting a potential buying opportunity for discerning investors.

Investors should approach the P/E ratio with caution. While a low P/E may suggest undervaluation, it can also highlight potential concerns regarding growth prospects or financial stability. It is essential to consider this metric alongside other financial ratios and industry trends.

Making Informed Investment Decisions

The P/E ratio is just one of several tools available to investors. To gain a comprehensive understanding of a company’s financial health, stakeholders should analyze financial statements, industry performance, and qualitative factors. By doing so, they can make more informed decisions that are likely to yield favorable investment outcomes.

Ultimately, while Amgen’s current stock performance and P/E ratio warrant careful consideration, an in-depth analysis will provide a clearer picture of the company’s future potential. Investors are encouraged to remain vigilant and utilize a variety of metrics in their evaluations.

This analysis reflects insights from Benzinga.com, emphasizing that investors should conduct thorough research before making financial commitments.

-

Science4 weeks ago

Science4 weeks agoUniversity of Hawaiʻi Joins $25.6M AI Initiative to Monitor Disasters

-

Lifestyle2 months ago

Lifestyle2 months agoToledo City League Announces Hall of Fame Inductees for 2024

-

Business2 months ago

Business2 months agoDOJ Seizes $15 Billion in Bitcoin from Major Crypto Fraud Network

-

Top Stories2 months ago

Top Stories2 months agoSharp Launches Five New Aquos QLED 4K Ultra HD Smart TVs

-

Sports2 months ago

Sports2 months agoCeltics Coach Joe Mazzulla Dominates Local Media in Scrimmage

-

Politics2 months ago

Politics2 months agoMutual Advisors LLC Increases Stake in SPDR Portfolio ETF

-

Health2 months ago

Health2 months agoCommunity Unites for 7th Annual Walk to Raise Mental Health Awareness

-

Science2 months ago

Science2 months agoWestern Executives Confront Harsh Realities of China’s Manufacturing Edge

-

World2 months ago

World2 months agoINK Entertainment Launches Exclusive Sofia Pop-Up at Virgin Hotels

-

Politics2 months ago

Politics2 months agoMajor Networks Reject Pentagon’s New Reporting Guidelines

-

Science1 month ago

Science1 month agoAstronomers Discover Twin Cosmic Rings Dwarfing Galaxies

-

Top Stories1 month ago

Top Stories1 month agoRandi Mahomes Launches Game Day Clothing Line with Chiefs