Business

Atlanta Braves and Sinclair: A Detailed Investment Comparison

In a comparative analysis of two consumer discretionary companies, the **Atlanta Braves** (OTCMKTS:BATRB) and **Sinclair** (NASDAQ:SBGI), significant differences emerge that may influence investment decisions. This article evaluates both companies based on their financial performance, dividends, profitability, and market perceptions.

Ownership and Analyst Insights

Institutional ownership plays a crucial role in assessing a company’s potential for growth. Currently, **41.7%** of **Sinclair** shares are held by institutional investors, reflecting substantial confidence from major financial players. In contrast, only **11.4%** of **Atlanta Braves** shares are owned by insiders, while **41.9%** of Sinclair shares are held by insiders, highlighting a stronger alignment of interests among Sinclair’s stakeholders.

Investor sentiment appears to favor Sinclair, as indicated by analyst ratings. According to MarketBeat.com, Sinclair holds a consensus price target of **$18.75**, suggesting a potential upside of **44.23%**. The ratings breakdown shows Sinclair receiving **1** sell rating, **3** hold ratings, and **2** buy ratings, yielding a score of **2.17**. In contrast, Atlanta Braves currently has no ratings indicating a lack of confidence from analysts.

Financial Performance and Valuation

Examining financial metrics reveals stark contrasts between the two companies. **Sinclair** reported gross revenue of **$3.55 billion**, with a price-to-sales ratio of **0.26**. Its net income stands at **$310 million**, resulting in earnings per share (EPS) of **$0.83** and a price-to-earnings (P/E) ratio of **15.66**. In contrast, **Atlanta Braves** generated revenue of **$662.75 million**, with a price-to-sales ratio of **4.97**. However, it recorded a net loss of **$21.97 million**, yielding an EPS of **($0.35)** and a P/E ratio of **150.00**.

These figures indicate that while Atlanta Braves may seem more affordable based on its P/E ratio, Sinclair’s robust revenue and profitability position it as a more stable investment option.

Volatility is also a determining factor for investors. The beta for Atlanta Braves is **0.32**, suggesting it is **68%** less volatile than the S&P 500. Conversely, Sinclair’s beta of **1.31** indicates a **31%** increase in volatility compared to the market. This reflects differing risk profiles, with Atlanta Braves offering more stability.

Profitability metrics further underscore Sinclair’s advantages. The company’s net margin stands at **1.44%**, with a return on equity of **12.51%** and a return on assets of **0.83%**. In comparison, Atlanta Braves has not disclosed these metrics, raising questions about its financial health.

In summary, Sinclair outperforms Atlanta Braves across **13** of the **14** factors compared, suggesting a clear preference for Sinclair among potential investors.

Company Profiles

**Atlanta Braves Holdings, Inc.** is primarily known for owning and operating the Atlanta Braves Major League Baseball club. The company also engages in mixed-use development projects, including retail and entertainment spaces. Established in **2022**, it is based in **Englewood, Colorado**.

On the other hand, **Sinclair, Inc.** is a media powerhouse that provides content across local television stations and digital platforms in the United States. Founded in **1971** and headquartered in **Hunt Valley, Maryland**, Sinclair operates two segments: Local Media and Tennis. The Local Media segment is responsible for broadcast television stations and original content distribution, while the Tennis segment includes the Tennis Channel and various streaming services.

In conclusion, while both companies share similarities as consumer discretionary entities, the data suggests that Sinclair presents a more compelling investment opportunity due to its stronger financial performance and institutional backing. Investors contemplating these two stocks should weigh these factors carefully before making decisions.

-

Science2 months ago

Science2 months agoUniversity of Hawaiʻi Joins $25.6M AI Initiative to Monitor Disasters

-

Science3 months ago

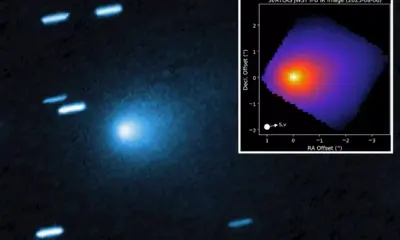

Science3 months agoInterstellar Object 3I/ATLAS Emits Unprecedented Metal Alloy

-

Lifestyle3 months ago

Lifestyle3 months agoToledo City League Announces Hall of Fame Inductees for 2024

-

Business3 months ago

Business3 months agoDOJ Seizes $15 Billion in Bitcoin from Major Crypto Fraud Network

-

Science3 months ago

Science3 months agoWestern Executives Confront Harsh Realities of China’s Manufacturing Edge

-

Top Stories3 months ago

Top Stories3 months agoSharp Launches Five New Aquos QLED 4K Ultra HD Smart TVs

-

Politics3 months ago

Politics3 months agoMutual Advisors LLC Increases Stake in SPDR Portfolio ETF

-

Sports3 months ago

Sports3 months agoCeltics Coach Joe Mazzulla Dominates Local Media in Scrimmage

-

Health3 months ago

Health3 months agoCommunity Unites for 7th Annual Walk to Raise Mental Health Awareness

-

Politics3 months ago

Politics3 months agoMajor Networks Reject Pentagon’s New Reporting Guidelines

-

World3 months ago

World3 months agoINK Entertainment Launches Exclusive Sofia Pop-Up at Virgin Hotels

-

Top Stories3 months ago

Top Stories3 months agoMicrosoft Releases Urgent Windows 11 25H2 Update for All Users