Health

ImmunityBio Reports 700% Revenue Growth, Boosting Investor Confidence

ImmunityBio Inc (NASDAQ: IBRX) has reported a remarkable revenue surge of approximately $113 million for the year 2025, reflecting a staggering 700% year-over-year increase. This significant growth has propelled the company’s stock, which has climbed nearly 96% year-to-date. The financial results, released on Thursday, highlight not only the company’s successful market positioning but also the effective commercialization of its lead oncology therapy, Anktiva.

Key Financial Milestones and Market Impact

The most notable figure in ImmunityBio’s report is the fourth-quarter revenue, which reached $38.3 million, up 431% from the same quarter the previous year. This growth has been attributed to the rapid commercialization of Anktiva, which is gaining market traction faster than many of its counterparts in the oncology sector. In a field where many drugs experience slow launches or difficulties in gaining market presence, Anktiva’s momentum signals a pivotal shift from traditional risks associated with clinical trials to tangible execution and market demand.

For investors, this transformation is crucial. Hedge funds are not merely reacting to market trends; they are strategically positioning themselves at inflection points. This latest surge in ImmunityBio’s revenue suggests a transition from speculative investments to a more stable pricing environment based on actual sales performance.

Investor Strategies and Market Reactions

Major hedge funds have taken notice of ImmunityBio’s rapid ascent. Renaissance Technologies initiated its investment in the quarter ending on September 30, 2025, while Citadel Advisors, led by Ken Griffin, increased its stake by over 40% during the same period. These moves reflect a calculated bet on the company’s potential for commercial success, focusing on whether revenue growth would outpace market expectations.

At around $5 per share, ImmunityBio still holds the characteristics of a speculative biotech investment. However, the astonishing growth rate demands a reevaluation. When early investments align with significant sales acceleration, the market often shifts from speculative debates to a focus on growth trajectories. This transition can lead to increased volatility, typically enhancing upward momentum.

The implications of this growth extend beyond ImmunityBio itself. As the biotech sector continues to evolve, the company’s performance may set a precedent for others in the industry. Investors are keenly watching how this momentum translates into sustained performance in the coming quarters, with the potential for broader market implications as similar biotech companies strive for comparable success.

In summary, ImmunityBio’s recent financial achievements not only validate the strategies of early investors but also signal a critical moment in the biotech market landscape. As the company continues to build on its momentum, stakeholders will be closely monitoring its next moves.

-

Science2 months ago

Science2 months agoUniversity of Hawaiʻi Joins $25.6M AI Initiative to Monitor Disasters

-

Science3 months ago

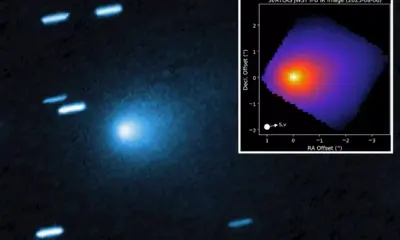

Science3 months agoInterstellar Object 3I/ATLAS Emits Unprecedented Metal Alloy

-

Lifestyle3 months ago

Lifestyle3 months agoToledo City League Announces Hall of Fame Inductees for 2024

-

Business3 months ago

Business3 months agoDOJ Seizes $15 Billion in Bitcoin from Major Crypto Fraud Network

-

Science3 months ago

Science3 months agoWestern Executives Confront Harsh Realities of China’s Manufacturing Edge

-

Top Stories3 months ago

Top Stories3 months agoSharp Launches Five New Aquos QLED 4K Ultra HD Smart TVs

-

Politics3 months ago

Politics3 months agoMutual Advisors LLC Increases Stake in SPDR Portfolio ETF

-

Health3 months ago

Health3 months agoCommunity Unites for 7th Annual Walk to Raise Mental Health Awareness

-

Sports3 months ago

Sports3 months agoCeltics Coach Joe Mazzulla Dominates Local Media in Scrimmage

-

Politics3 months ago

Politics3 months agoMajor Networks Reject Pentagon’s New Reporting Guidelines

-

World3 months ago

World3 months agoINK Entertainment Launches Exclusive Sofia Pop-Up at Virgin Hotels

-

Top Stories3 months ago

Top Stories3 months agoMicrosoft Releases Urgent Windows 11 25H2 Update for All Users