Politics

Treasury Fund Transforms Communities Through Strategic Investments

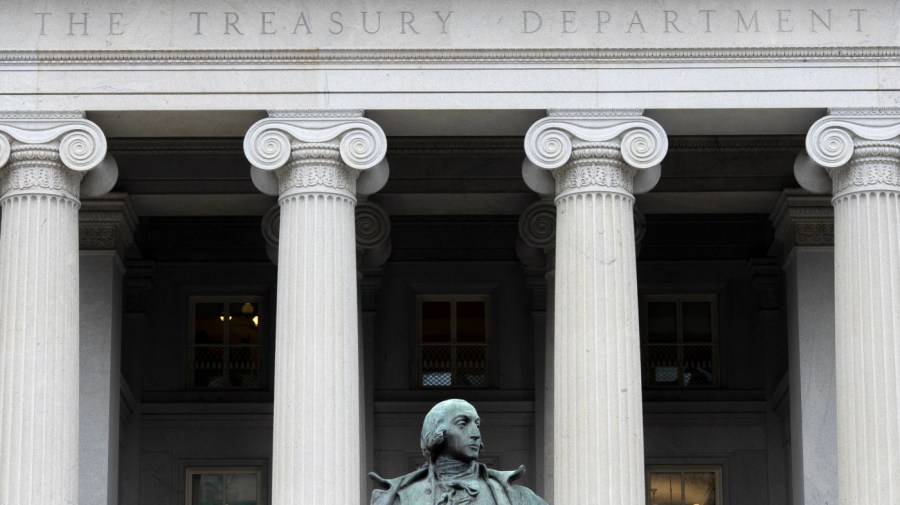

The U.S. Treasury’s Community Development Financial Institutions (CDFI) Fund is proving to be a crucial tool for community development, leveraging limited federal funding into significant local investments. This initiative has fostered economic growth in underserved areas, highlighting the importance of continued support rather than abandonment of such programs.

The CDFI Fund focuses on improving access to capital for communities that often lack sufficient financial resources. By providing targeted investments, it has enabled various projects that aim to enhance local economies and improve living conditions. According to the U.S. Treasury, every dollar allocated through the CDFI Fund can generate approximately $12 in private investment, demonstrating its substantial impact.

Impact on Local Communities

One notable example is the funding provided for affordable housing projects. In March 2023, the CDFI Fund facilitated investments that supported the construction of over 5,000 affordable housing units across the United States. This initiative not only addresses the pressing need for housing but also stimulates local economies by creating jobs and boosting local businesses.

Community Development Financial Institutions play a pivotal role in this process. These organizations work closely with the CDFI Fund to identify and invest in projects that serve low-income populations. By focusing on the specific needs of communities, CDFIs can tailor their investments to ensure maximum effectiveness.

The impact of the CDFI Fund extends beyond housing. It also supports small business development, healthcare access, and education initiatives. For instance, investments in local healthcare facilities have improved access to medical services for thousands of residents, directly enhancing community health outcomes.

The Case for Continued Support

As discussions surrounding federal budgets and priorities unfold, some policymakers suggest cutting programs like the CDFI Fund. Critics argue that such measures could undermine years of progress in community development. Advocates emphasize that instead of abolishing the fund, efforts should focus on expanding its reach to further benefit underserved communities.

Data from the Federal Reserve indicates that communities receiving support from the CDFI Fund experience faster economic recovery and resilience in times of financial crisis. This resilience is particularly vital in light of recent economic downturns and the ongoing effects of the COVID-19 pandemic.

Investing in community development not only helps reduce poverty but also fosters a sense of belonging and empowerment among residents. The CDFI Fund stands as a testament to the potential of federal resources when strategically allocated, proving that small investments can yield significant returns.

The call to action from various community leaders and organizations is clear: protect and enhance the CDFI Fund. By prioritizing such initiatives, the U.S. can continue to build stronger, more equitable communities for all citizens. The success of the CDFI Fund serves as a model for future investments aimed at promoting sustainable development and economic equality across the nation.

-

Science4 weeks ago

Science4 weeks agoUniversity of Hawaiʻi Joins $25.6M AI Initiative to Monitor Disasters

-

Lifestyle2 months ago

Lifestyle2 months agoToledo City League Announces Hall of Fame Inductees for 2024

-

Business2 months ago

Business2 months agoDOJ Seizes $15 Billion in Bitcoin from Major Crypto Fraud Network

-

Top Stories2 months ago

Top Stories2 months agoSharp Launches Five New Aquos QLED 4K Ultra HD Smart TVs

-

Sports2 months ago

Sports2 months agoCeltics Coach Joe Mazzulla Dominates Local Media in Scrimmage

-

Health2 months ago

Health2 months agoCommunity Unites for 7th Annual Walk to Raise Mental Health Awareness

-

Politics2 months ago

Politics2 months agoMutual Advisors LLC Increases Stake in SPDR Portfolio ETF

-

Science2 months ago

Science2 months agoWestern Executives Confront Harsh Realities of China’s Manufacturing Edge

-

World2 months ago

World2 months agoINK Entertainment Launches Exclusive Sofia Pop-Up at Virgin Hotels

-

Politics2 months ago

Politics2 months agoMajor Networks Reject Pentagon’s New Reporting Guidelines

-

Science1 month ago

Science1 month agoAstronomers Discover Twin Cosmic Rings Dwarfing Galaxies

-

Top Stories1 month ago

Top Stories1 month agoRandi Mahomes Launches Game Day Clothing Line with Chiefs