Sports

Scotiabank Raises Cogeco Communications Price Target to C$75.50

Cogeco Communications (TSE:CCA) has seen its price target adjusted upward by Scotiabank, moving from C$75.00 to C$75.50. This revision was detailed in a research report released on October 16, 2023, where Scotiabank maintained a “sector perform” rating for the stock. The adjustment reflects an ongoing analysis of the company’s performance within the telecommunications sector.

Several other analysts have also recently updated their evaluations of Cogeco Communications. On October 17, 2023, CIBC reduced its price target from C$71.00 to C$68.00. Just prior, BMO Capital Markets lowered its target from C$80.00 to C$75.00 on July 17, 2023. Earlier in the summer, National Bank Financial downgraded the stock from a “strong-buy” to a “hold” rating as of August 11, 2023. Royal Bank of Canada also adjusted their target price from C$75.00 to C$74.00 on the same day as BMO’s revision.

In addition, Desjardins set a price target of C$73.00 and issued a “hold” rating on October 9, 2023. Currently, two research analysts have rated the stock as a “Buy,” while five have given it a “Hold” rating. According to MarketBeat.com, Cogeco Communications enjoys a consensus rating of “Hold” with an average price target of C$75.28.

Dividend Announcement and Financial Overview

Cogeco Communications also made headlines recently by announcing a quarterly dividend. This payment was issued on August 12, 2023, to shareholders on record as of the same date. The dividend amount was set at $0.922, with the ex-dividend date occurring on July 29, 2023. This translates to an annualized dividend of $3.69, corresponding to a yield of 5.5%. The company’s current payout ratio stands at 46.89%, indicating a balanced approach to returning value to shareholders while maintaining sufficient capital for growth.

Cogeco Communications operates primarily as a cable provider in North America, focusing on the Canadian market. The company delivers a range of services, including internet, video, and telephony, utilizing advanced broadband fibre networks. Its operations are divided into two reportable segments: Canadian broadband services and American broadband services.

As the telecommunications industry continues to evolve, Cogeco’s strategic decisions and performance will be closely monitored by investors and analysts alike. The adjustments from various financial institutions indicate a cautious optimism regarding the company’s future prospects, reflecting broader trends within the sector.

-

Science2 months ago

Science2 months agoUniversity of Hawaiʻi Joins $25.6M AI Initiative to Monitor Disasters

-

Science3 months ago

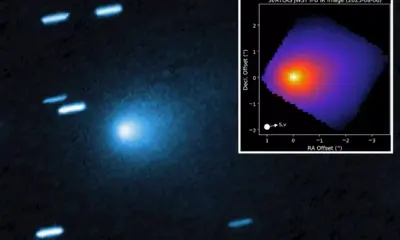

Science3 months agoInterstellar Object 3I/ATLAS Emits Unprecedented Metal Alloy

-

Lifestyle3 months ago

Lifestyle3 months agoToledo City League Announces Hall of Fame Inductees for 2024

-

Business3 months ago

Business3 months agoDOJ Seizes $15 Billion in Bitcoin from Major Crypto Fraud Network

-

Science3 months ago

Science3 months agoWestern Executives Confront Harsh Realities of China’s Manufacturing Edge

-

Politics3 months ago

Politics3 months agoMutual Advisors LLC Increases Stake in SPDR Portfolio ETF

-

Top Stories3 months ago

Top Stories3 months agoSharp Launches Five New Aquos QLED 4K Ultra HD Smart TVs

-

Health3 months ago

Health3 months agoCommunity Unites for 7th Annual Walk to Raise Mental Health Awareness

-

Sports3 months ago

Sports3 months agoCeltics Coach Joe Mazzulla Dominates Local Media in Scrimmage

-

Politics3 months ago

Politics3 months agoMajor Networks Reject Pentagon’s New Reporting Guidelines

-

World3 months ago

World3 months agoINK Entertainment Launches Exclusive Sofia Pop-Up at Virgin Hotels

-

Top Stories3 months ago

Top Stories3 months agoMicrosoft Releases Urgent Windows 11 25H2 Update for All Users