Top Stories

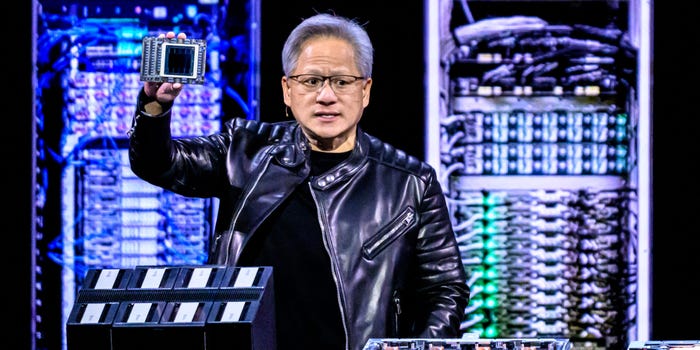

Nvidia’s Blockbuster Earnings Surge Tech Stocks, Revive AI Trade

UPDATE: Nvidia’s astonishing third-quarter earnings have just reignited the tech sector, sending stocks soaring and breathing new life into the previously faltering AI trade. The chipmaker’s results, released yesterday, have created an immediate ripple effect across the industry, as shares surged by 5% and bolstered investor confidence.

Nvidia reported a staggering $57 billion in revenue for the quarter, marking a jaw-dropping 62% increase year-over-year. The company’s data center revenue alone hit $51.2 billion, up 66% from last year. This performance exceeded analysts’ expectations, with Nvidia projecting $65 billion in revenue for the upcoming quarter, far surpassing the anticipated $61 billion.

Tech stocks reacted positively to this news, with significant gains across the board:

– Super Micro Computer: +6.4%

– Nvidia: +5.0%

– Advanced Micro Devices: +4.6%

– Broadcom: +3.3%

– Taiwan Semiconductor Manufacturing: +2.7%

– Intel: +2.1%

Major indexes rallied decisively, with the Nasdaq leading the charge, surging over 2% as markets opened at 9:30 a.m. on Thursday. Here’s how the U.S. indexes stood:

– S&P 500: 6,742.50, up 1.5%

– Dow Jones Industrial Average: 46,637.69, up 1.13% (+521 points)

– Nasdaq Composite: 23,037.78, up 2%

The renewed confidence in the AI sector comes after weeks of concern over high valuations and increasing capital expenditures directed toward AI initiatives. Jensen Huang, Nvidia’s CEO, is being hailed as a pivotal figure in the AI revolution, with analysts asserting that his insights have provided much-needed reassurance to investors.

David Rosenberg, president of Rosenberg Research, emphasized the significance of Nvidia’s performance, noting,

“It has been many decades since one stock could move the market like Nvidia. The company did indeed deliver across the top line, bottom line, and forward guidance after the bell yesterday.”

Dan Ives from Wedbush Securities echoed this sentiment, stating, “In a nutshell, there is one company in the world that is the foundation for the AI Revolution, and that is Nvidia.”

However, despite the surge in optimism, some analysts remain cautious. Rosenberg warned,

“This remains a bubble of epic proportions, keep that in mind,”

suggesting skepticism about the AI market’s projected growth over the next five years.

As investors digest these developments, all eyes are on Nvidia and the broader tech landscape. The next few days will be critical to see if this momentum continues, or if lingering concerns about an AI bubble will dampen investor enthusiasm once more.

Stay tuned for more updates as this story develops.

-

Science4 weeks ago

Science4 weeks agoUniversity of Hawaiʻi Joins $25.6M AI Initiative to Monitor Disasters

-

Lifestyle2 months ago

Lifestyle2 months agoToledo City League Announces Hall of Fame Inductees for 2024

-

Business2 months ago

Business2 months agoDOJ Seizes $15 Billion in Bitcoin from Major Crypto Fraud Network

-

Top Stories2 months ago

Top Stories2 months agoSharp Launches Five New Aquos QLED 4K Ultra HD Smart TVs

-

Sports2 months ago

Sports2 months agoCeltics Coach Joe Mazzulla Dominates Local Media in Scrimmage

-

Politics2 months ago

Politics2 months agoMutual Advisors LLC Increases Stake in SPDR Portfolio ETF

-

Health2 months ago

Health2 months agoCommunity Unites for 7th Annual Walk to Raise Mental Health Awareness

-

Science2 months ago

Science2 months agoWestern Executives Confront Harsh Realities of China’s Manufacturing Edge

-

World2 months ago

World2 months agoINK Entertainment Launches Exclusive Sofia Pop-Up at Virgin Hotels

-

Politics2 months ago

Politics2 months agoMajor Networks Reject Pentagon’s New Reporting Guidelines

-

Science1 month ago

Science1 month agoAstronomers Discover Twin Cosmic Rings Dwarfing Galaxies

-

Top Stories1 month ago

Top Stories1 month agoRandi Mahomes Launches Game Day Clothing Line with Chiefs